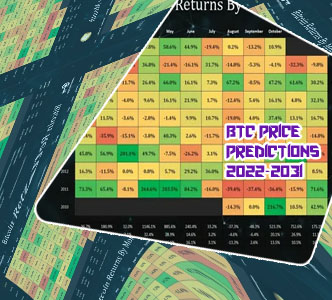

Bitcoin 10 year chart

Over the past decade, Bitcoin has experienced significant price fluctuations, making it a popular topic of discussion among investors and analysts. Understanding the historical performance of Bitcoin can provide valuable insights into its future potential. To help navigate through the Bitcoin 10 year chart, here are three articles that offer in-depth analysis and insights into this digital asset's price movements:

Decade of Bitcoin: A Comprehensive Analysis of Its Price Performance Over the Past 10 Years

Over the past decade, Bitcoin has emerged as a revolutionary digital asset that has captured the attention of investors, tech enthusiasts, and the general public worldwide. This comprehensive analysis delves into the price performance of Bitcoin over the past 10 years, shedding light on its meteoric rise and volatile nature.

One of the key takeaways from this analysis is the staggering growth of Bitcoin's price since its inception in 2009. Starting off at a fraction of a cent, Bitcoin's price has skyrocketed to thousands of dollars, making early adopters incredibly wealthy in the process.

Another notable aspect of Bitcoin's price performance is its extreme volatility. The cryptocurrency has experienced massive price swings, with sharp surges followed by steep corrections. This volatility has made Bitcoin a high-risk, high-reward investment, attracting both seasoned traders and novice investors alike.

Despite its volatility, Bitcoin has shown remarkable resilience over the past decade, surviving numerous market crashes, regulatory challenges, and technological hurdles. This resilience has solidified Bitcoin's status as a digital gold and a store of value in the eyes of many investors.

Overall, this analysis provides valuable insights into the price performance of Bitcoin over the past 10 years, highlighting its exponential growth, extreme volatility, and enduring resilience. As we look towards the future,

Exploring the Trends: Key Factors Influencing Bitcoin's Price Volatility Over the Years

Over the years, Bitcoin has experienced significant price volatility, influenced by a variety of key factors. These trends have played a crucial role in shaping the value of the popular cryptocurrency. One of the primary factors influencing Bitcoin's price volatility is market demand. As demand for Bitcoin increases, so does its price, creating a cycle of fluctuation that has been observed over the years.

Another key factor that impacts Bitcoin's price volatility is regulatory developments. Government regulations and policies can have a significant impact on the value of Bitcoin, causing prices to rise or fall depending on the regulatory environment. Additionally, technological advancements and innovations in the cryptocurrency space can also contribute to price volatility, as new developments can either increase or decrease the value of Bitcoin.

Overall, it is clear that a combination of factors influences Bitcoin's price volatility, making it a dynamic and ever-changing market. As investors navigate these trends, it is important to stay informed and adapt to the changing landscape of the cryptocurrency market.

Feedback from a resident of World:

As a resident of World, I have been closely following the trends in Bitcoin's price volatility. I believe that the article provides a comprehensive overview of the key factors influencing Bitcoin's price fluctuations over the years. The analysis of market demand, regulatory developments, and technological advancements offers valuable insights for

Lessons Learned: How Historical Bitcoin Price Data Can Inform Investment Strategies for the Future

In this insightful article, the authors delve into the historical price <a href"https://changelly.com/buy/xmr">https://changelly.com/buy/xmr data of Bitcoin to draw valuable lessons that can inform investment strategies for the future.