Bitcoins lowest price

With the volatility of the cryptocurrency market, it can be challenging to predict when Bitcoin will hit its lowest price. However, by staying informed and following expert analysis, investors can make more informed decisions about when to buy or sell. Below are two articles that provide valuable insights and strategies for navigating Bitcoin's lowest price fluctuations.

Strategies for Buying Bitcoin at Its Lowest Price

Bitcoin has become a popular investment choice for many individuals seeking to capitalize on the potential for high returns. However, the volatile nature of the cryptocurrency market can make it challenging to determine the best time to buy. By employing certain strategies, investors can increase their chances of purchasing Bitcoin at its lowest price.

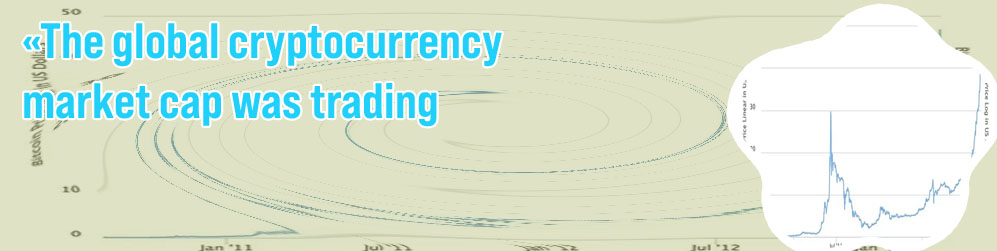

One effective strategy for buying Bitcoin at a low price is to keep a close eye on market trends. By monitoring price movements and analyzing historical data, investors can identify patterns that may indicate when Bitcoin is likely to be at its lowest point. Additionally, setting price alerts can help investors capitalize on sudden price drops and make purchases at opportune moments.

Another key strategy is to dollar-cost average. This involves investing a fixed amount of money in Bitcoin at regular intervals, regardless of the current price. By spreading out purchases over time, investors can mitigate the impact of market volatility and potentially buy Bitcoin at a lower average price.

Furthermore, taking advantage of dips in the market can be a profitable strategy for buying Bitcoin at its lowest price. When prices temporarily decrease, investors can capitalize on these opportunities to acquire Bitcoin at a discounted rate.

In conclusion, employing these strategies can help investors buy Bitcoin at its lowest price, maximizing their potential for profits in the long run. By staying informed, remaining patient, and

Expert Tips for Timing the Bitcoin Market to Maximize Profit

Investing in Bitcoin can be a lucrative venture if done correctly, but timing the market can be a challenging task. Here are some expert tips to help you maximize profit when trading in the volatile world of cryptocurrency:

-

Stay Informed: Keeping up to date with the latest news and trends in the cryptocurrency market is crucial. Be aware of any regulatory changes, technological advancements, or major events that could impact the price of Bitcoin.

-

Use Technical Analysis: Utilizing technical analysis tools can help you identify patterns and trends in Bitcoin's price movements. This can help you make more informed decisions about when to buy or sell your Bitcoin.

-

Set Realistic Goals: It's essential to have a clear strategy and set realistic goals when trading Bitcoin. Determine your risk tolerance, profit targets, and stop-loss levels before entering a trade to avoid emotional decision-making.

-

Diversify Your Portfolio: Instead of putting all your eggs in one basket, consider diversifying your investments across different asset classes. This can help spread risk and protect your portfolio from market fluctuations.

-

Practice Patience: Timing the market perfectly is nearly impossible, so it's essential to be patient and disciplined in your trading approach. Avoid making impulsive decisions based on FOMO (fear of missing