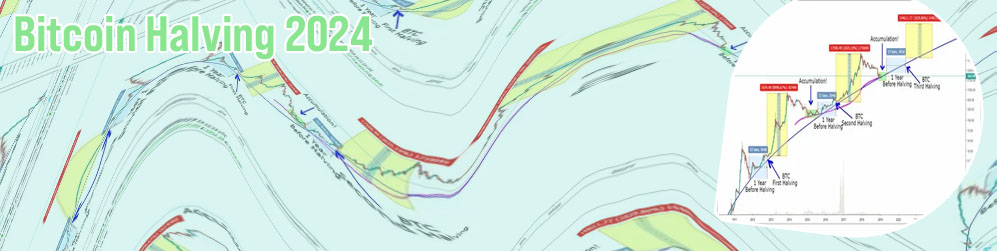

Bitcoin halving

Bitcoin halving is an important event in the cryptocurrency world that occurs approximately every four years. It refers to the reduction of the reward that miners receive for verifying transactions on the Bitcoin network. This event often leads to increased attention from investors and traders, as it can impact the supply and demand dynamics of Bitcoin. To better understand Bitcoin halving and its implications, consider reading the following articles:

The Impact of Bitcoin Halving on Price Volatility

Bitcoin halving is a significant event in the world of cryptocurrency that occurs approximately every four years. During this event, the rewards miners receive for validating transactions are cut in half, leading to a decrease in the rate at which new Bitcoins are created. This reduction in the supply of new Bitcoins has a direct impact on the price volatility of the cryptocurrency.

Historically, Bitcoin halving events have been associated with increased price volatility. This is because the reduction in supply often leads to increased demand from investors looking to capitalize on the scarcity of new coins. As a result, the price of Bitcoin tends to experience sharp fluctuations in the months leading up to and following a halving event.

Investors and traders should be aware of the potential impact of Bitcoin halving on price volatility and take this into consideration when making investment decisions. It is important to closely monitor market trends and news surrounding halving events in order to make informed choices about buying, selling, or holding Bitcoin.

In order to better understand the impact of Bitcoin halving on price volatility, it is recommended to consider factors such as historical price data, market sentiment, and the behavior of other cryptocurrencies during halving events. Additionally, analyzing the role of institutional investors and regulatory developments in the cryptocurrency market can provide valuable insights into the future price movements

Strategies for Investing During Bitcoin Halving Events

Bitcoin halving events are crucial milestones in the world of cryptocurrency investing. These events, which occur approximately every four years, have a significant impact on the supply and demand dynamics of Bitcoin. As a result, investors need to carefully consider their strategies during these periods to maximize their returns. Here are some key strategies to keep in mind when investing during Bitcoin halving events:

-

HODL: One of the most popular strategies during Bitcoin halving events is to simply hold onto your existing Bitcoin holdings. Historically, the price of Bitcoin has tended to increase in the months following a halving event, so holding onto your coins can potentially lead to significant profits.

-

Dollar-cost averaging: Another strategy to consider during Bitcoin halving events is dollar-cost averaging. This involves consistently purchasing a fixed amount of Bitcoin at regular intervals, regardless of the price. By spreading out your purchases over time, you can mitigate the effects of price volatility and potentially lower your average cost per coin.

-

Stay informed: It's crucial to stay informed about the latest developments in the cryptocurrency market during Bitcoin halving events. Keep an eye on news and analysis from reputable sources, as well as monitoring the price of Bitcoin and other cryptocurrencies. This will help you make informed decisions about when to buy or sell